If there is one country that demands perfection in automotive engineering, it is Germany. Home to Volkswagen, BMW, and Mercedes-Benz, Germany is the holy grail for auto component manufacturers.

For decades, German companies looked to China or Eastern Europe for sourcing. But the tide has turned. With India’s auto component exports crossing $5.1 billion to Germany in 2024, Indian manufacturers are now seen as strategic partners, not just low-cost alternatives.

This guide covers everything you need to know: from the specific parts German buyers want, to the strict certifications you need, and a curated list of top buyers.

1. Market Intelligence: What is Germany Buying?

According to recent trade data (Volza/Commerce Ministry), India exported over 5,125 shipments of auto components to Germany in the last 12 months alone. The growth is driven by a "China Plus One" strategy where German OEMs (Original Equipment Manufacturers) are diversifying their supply chains.

Top 5 Export Categories (High Demand):

Forging & Casting Components: Crankshafts, connecting rods, and camshafts. Germany values India's metallurgy expertise (especially from hubs like Pune and Ludhiana).

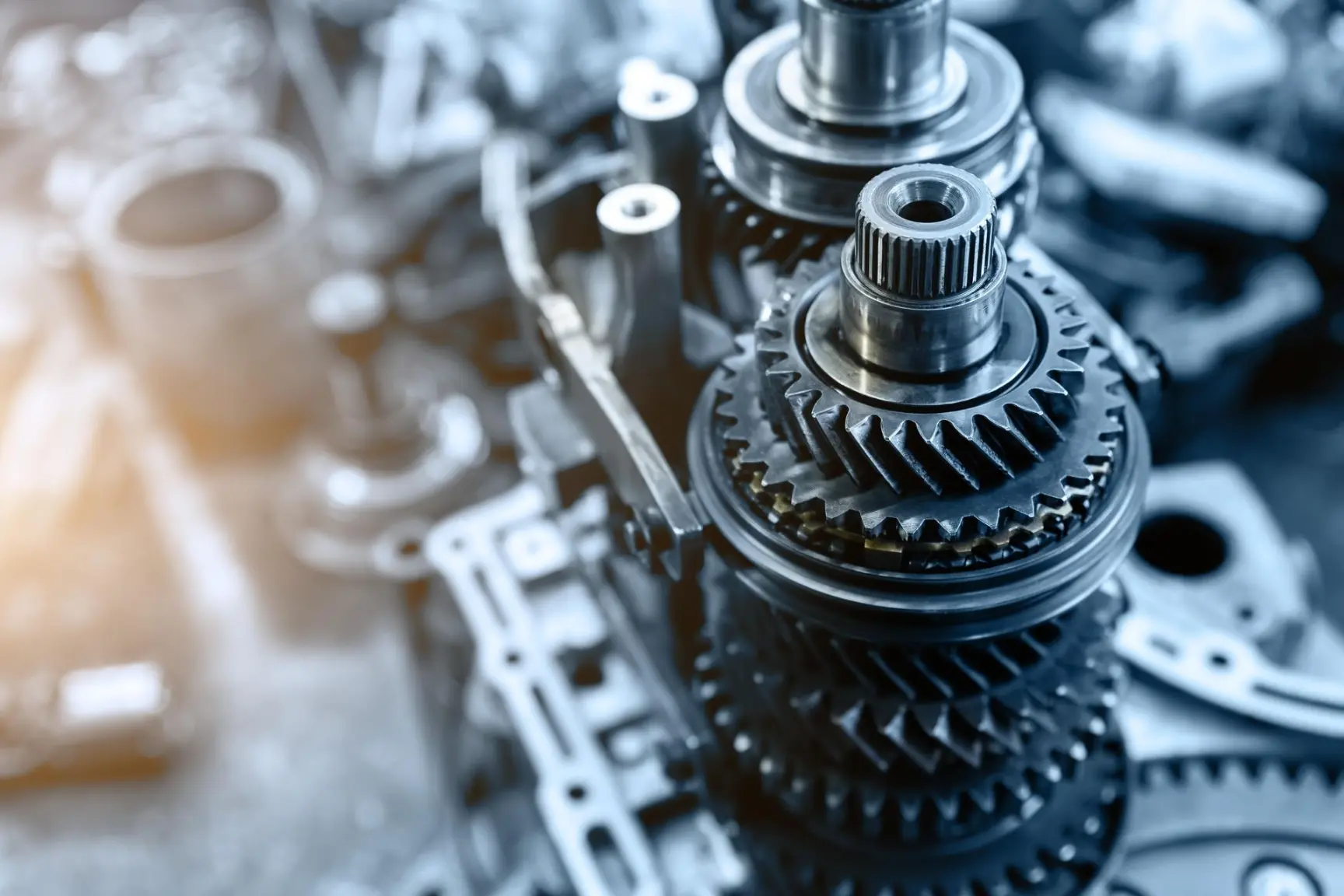

Transmission Parts: Gears, clutch plates, and drive axles.

Rubber Components: Anti-vibration mounts, hoses, and seals.

Electricals: Wiring harnesses and sensors (growing demand due to the EV shift).

Fasteners: High-tensile precision screws and bolts.

Key Indian Sourcing Hubs:

Chennai ("The Detroit of Asia"): Best for engine and transmission parts.

Pune/Aurangabad: The hub for forging and heavy chassis components.

Manesar/Gurugram: Known for electricals and precision finishing.

2. The "Barrier to Entry": Certifications & Compliance

You cannot export to Germany with just a "good product." You need the right paperwork. German procurement managers are risk-averse; without these stamps, your email will be deleted.

IATF 16949: The absolute gold standard. If you are not IATF certified, you cannot supply to Tier-1 buyers.

VDA 6.3: A specifically German quality management standard (Verband der Automobilindustrie). Having this is a massive "trust signal" for buyers like BMW or VW.

CE Marking: Mandatory for electronic/electrical components to enter the EU.

REACH Compliance: Ensures your rubber/plastic parts do not contain banned chemical substances.

ISO 14001: Increasingly requested for "Green Supply Chain" compliance.

3. The Export Logistics: From Factory to Autobahn

Shipping Routes: Most auto parts ship via JNPT (Mumbai) or Mundra (Gujarat) to Hamburg or Bremerhaven in Germany.

Transit Time: Approx. 24–28 days by sea.

Packaging (Crucial): Germans hate waste but demand protection. Use VCI (Volatile Corrosion Inhibitor) bags for metal parts to prevent rust during the sea voyage. Use returnable/recyclable packaging (like steel pallets) if possible to score sustainability points.

4. Top 20 Potential Buyers in Germany (Categorized)

This list includes OEMs (Car Makers), Tier-1 Suppliers (who buy parts to make systems), and Aftermarket Distributors (who buy ready-to-sell parts).

Category A: The Giants (OEMs)

Direct entry is hard. You usually register on their supplier portals first.

Volkswagen Group (Wolfsburg) - Largest buyer. Uses "ONE.Konzern Business Platform" for sourcing.

BMW Group (Munich) - Focuses heavily on high-precision engine and EV parts.

Mercedes-Benz (Stuttgart) - Requires high aesthetic and finish quality.

Ford-Werke GmbH (Cologne) - Major manufacturing hub for Ford in Europe.

Opel Automobile (Rüsselsheim) - Now part of Stellantis, but maintains German sourcing ops.

Category B: The Tier-1 Kings (Your Best Targets)

These companies supply the OEMs. They are easier to approach than VW or BMW directly.

Robert Bosch GmbH: The world's largest supplier. Buys massive volumes of electronics and machined parts.

ZF Friedrichshafen: Leader in transmissions. Huge buyer of gears and shafts.

Continental AG: Buys rubber parts, tires, and electronics.

Schaeffler AG: Famous for bearings. Buys turned metal parts and steel rings.

Mahle GmbH: Focuses on pistons and engine systems.

Hella (Forvia): Specializes in lighting. Buys plastics and wiring.

Brose Fahrzeugteile: Leader in door/seat systems. Buys motors and mechanisms.

Webasto: Roof systems. Buys glass, rubber, and plastic seals.

Category C: Aftermarket Distributors (For Ready Parts)

These companies buy branded or white-label parts to sell to mechanics and shops.

Stahlgruber GmbH: One of the largest independent parts distributors in Germany.

WM SE (Wessels + Müller): A massive wholesaler with over 200 locations.

PV Automotive GmbH: Major distributor in Western Germany.

Matthies GmbH: Based in Hamburg, strong in Northern Germany.

Alliance Automotive Group (Germany): A huge buying group that owns brands like Coler and Hennig.

Motoo: A large network of independent workshops that sources parts centrally.

Carat Unternehmensgruppe: A buying group for independent parts dealers.

5. How to Pitch to German Buyers (The "German Way")

Doing business in Germany is different from the US or UK. Here is how to win:

Be Direct & Factual: Skip the "We are the best in the world" marketing fluff. Germans want facts: "We have 5 CNC machines, <100 PPM rejection rate, and IATF 16949 certification."

The "VDA" Card: Mention in your subject line if you follow VDA standards. It opens doors.

Punctuality is Religion: If you say you will send a quote by Tuesday 2:00 PM, send it by 1:55 PM. Late replies are seen as a sign of poor quality control.

Attend "Automechanika Frankfurt": It is the world's biggest trade fair. Even if you don't have a booth, visiting to meet buyers is the highest ROI investment you can make.

6. Actionable Links for Supplier Registration

VW Group: vwgroupsupply.com

BMW Group: b2b.bmw.com

Bosch: purchasing.bosch.com

ZF: zf.com/supplier