Water is the new oil. With global water scarcity intensifying and strict environmental norms in the Middle East and Africa (MEA), the demand for "Clean Water Chemicals" is exploding.

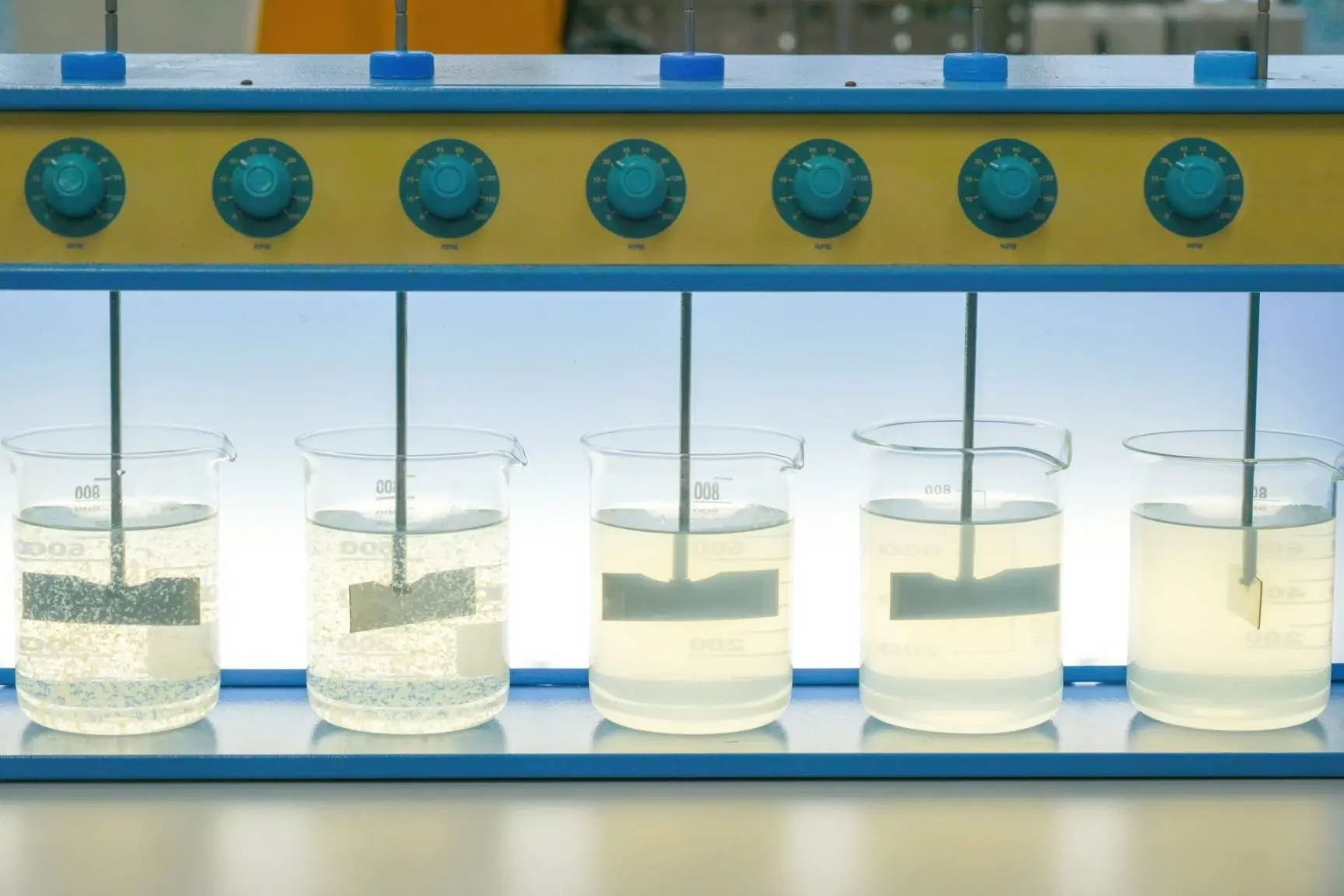

India is uniquely positioned to dominate this space. Unlike generic bulk chemicals, water treatment chemicals (coagulants, flocculants, and biocides) are high-value, recurring-revenue products. Once a municipal plant in Dubai or a textile mill in Bangladesh sets its process to your chemical formulation, they rarely switch.

This guide provides the latest market data, HS codes, and a curated list of buyers to help you navigate this profitable sector.

1. Market Intelligence: The Numbers (2024-25)

India's chemical industry is the 6th largest globally, but the "Water Treatment" niche is outperforming the general market.

Growth Rate: The Indian water treatment chemicals market is projected to grow at a CAGR of ~11% (2025-2030).

Export Hotspots:

Bangladesh & Nepal: Textile and municipal demands.

UAE & Saudi Arabia: Desalination plants (Reverse Osmosis chemicals).

Vietnam & Indonesia: Industrial effluent treatment.

Egypt: Municipal water purification.

Key Driver: The Middle East & Africa (MEA) market alone is expected to cross $6.1 Billion by 2030. They have the money but lack the water; India has the chemistry.

2. Top Exportable Products & HS Codes

Water treatment is a broad term. To export successfully, you must drill down into specific niches.

| Product Category | HS Code | Description & Use Case | Target Market |

| Coagulants | 3824 99 00 | Poly Aluminium Chloride (PAC) & Alum. Used to clump dirt particles together in raw water. | Municipalities in Africa & Bangladesh. |

| Disinfectants | 2828 10 10 | Calcium Hypochlorite (Bleaching Powder). Used to kill bacteria/viruses. | Public Health Depts globally. |

| RO Chemicals | 3824 99 22 | Antiscalants & Membrane Cleaners. Prevents salt crusts on expensive RO membranes. | UAE, Saudi Arabia, Qatar (Desalination). |

| Ion Exchange Resins | 3914 00 00 | Small beads used for water softening and demineralization. | Power Plants & Pharma industries in Europe/USA. |

| Biocides | 3808 94 00 | Prevents algae/slime growth in cooling towers. | Industrial zones in SE Asia. |

3. The Buyer Landscape: Who Imports?

In the water business, you rarely sell to the "Government" directly. You sell to the EPC Contractors (who build the plants) or O&M Companies (who run them).

A. Middle East (Desalination Giants)

Suez Water Technologies (Dubai): A global giant managing massive desalination projects. They source huge volumes of antiscalants and corrosion inhibitors.

Veolia Water Technologies (Saudi Arabia/UAE): The world’s leading water company. They have strict vendor registration but buy consistently.

Al Khowahir Chemicals (Sharjah, UAE): A major distributor stocking chemicals for swimming pools and industrial treatment.

Green Water Treatment Solutions (GreenWTS) (UAE): A specialized trading house for RO chemicals and consumables.

B. Africa & Asia (Industrial Use)

AES Arabia (Saudi/Global): Focuses on industrial water and wastewater treatment.

Brandix / MAS Holdings (Sri Lanka/India): Textile giants that consume massive amounts of Effluent Treatment Plant (ETP) chemicals.

Local Distributors: In countries like Kenya and Nigeria, you must work with local chemical distributors who break bulk drums into smaller jerry cans for local factories.

4. Regulatory Compliance: The "Safety" Barrier

Exporting chemicals is not like exporting rice. It is a "Zero Error" business.

1. REACH Compliance (Europe):

If you export to Europe, your chemical must be REACH registered. Without this, your shipment will be seized.

2. MSDS (Material Safety Data Sheet):

You cannot ship a sample without a 16-point MSDS. It tells the buyer (and the shipping line) how to handle a leak or fire.

3. Pre-Shipment Inspection (SGS/Intertek):

Most African buyers (e.g., for Kenya/Egypt) will insist on an SGS inspection report before the container leaves Nhava Sheva to certify purity.

5. Logistics: The "Hazardous" Trap

Many water chemicals (like Calcium Hypochlorite) are classified as "Dangerous Goods" (DG).

Class 5.1 (Oxidizer): Calcium Hypochlorite. Can catch fire if mixed with oil. Needs special "IMO Approved" containers.

Class 8 (Corrosive): Acids/Alkalis.

Packaging:

Liquids: 200L HDPE Drums or 1000L IBC Tanks.

Powders: 25kg PP Bags with inner liners.

Palletization: Always palletize and shrink-wrap your drums. Loose drums are often rejected at automated ports in Dubai/Europe.

6. Action Plan for Exporters

Don't sell "Water Chemicals": Be specific. Pitch "Antiscalant for High-Silica Water" or "High-Basicity PAC for Textile Effluent." Specificity builds trust.

Target the "O&M" Contracts: Look for companies that have won "Operations & Maintenance" contracts for municipal plants. They are under pressure to cut costs and are open to switching to cheaper Indian suppliers.

Get Certified: An NSF/ANSI 60 certification (USA standard for drinking water chemicals) is a golden ticket. It instantly proves your chemical is safe for human consumption.