By Sanskriti Global Exports by Himanshu Gupta

India's Trade Landscape: Daily Import-Export Roundup (September 22, 2025)

Good morning, and welcome to today's in-depth analysis of the global trade environment and its direct implications for Indian import-export businesses. September 22nd, 2025, saw significant shifts in several key sectors, necessitating a close examination of their potential impact on Indian trade strategies. This daily roundup aims to provide a concise yet comprehensive overview, highlighting critical developments and offering actionable insights for professionals navigating the complexities of international commerce.

Factual Summary:

Today's trade news is dominated by three key areas: fluctuating energy prices, escalating trade tensions between the US and China, and the ongoing impact of the strengthening US dollar. Crude oil prices experienced a sharp increase, surging by approximately 5% following unexpected production cuts from OPEC+. This directly impacts India's import bill, as the nation is a significant importer of crude oil. Simultaneously, the ongoing trade dispute between the US and China continues to escalate, with both nations imposing further tariffs on various goods. This creates uncertainty for Indian businesses relying on intermediary trade between these two giants. Adding to this complexity, the strengthening US dollar continues to affect global trade dynamics, making imports more expensive for India while potentially boosting exports in the short term, though with long-term consequences for competitiveness.

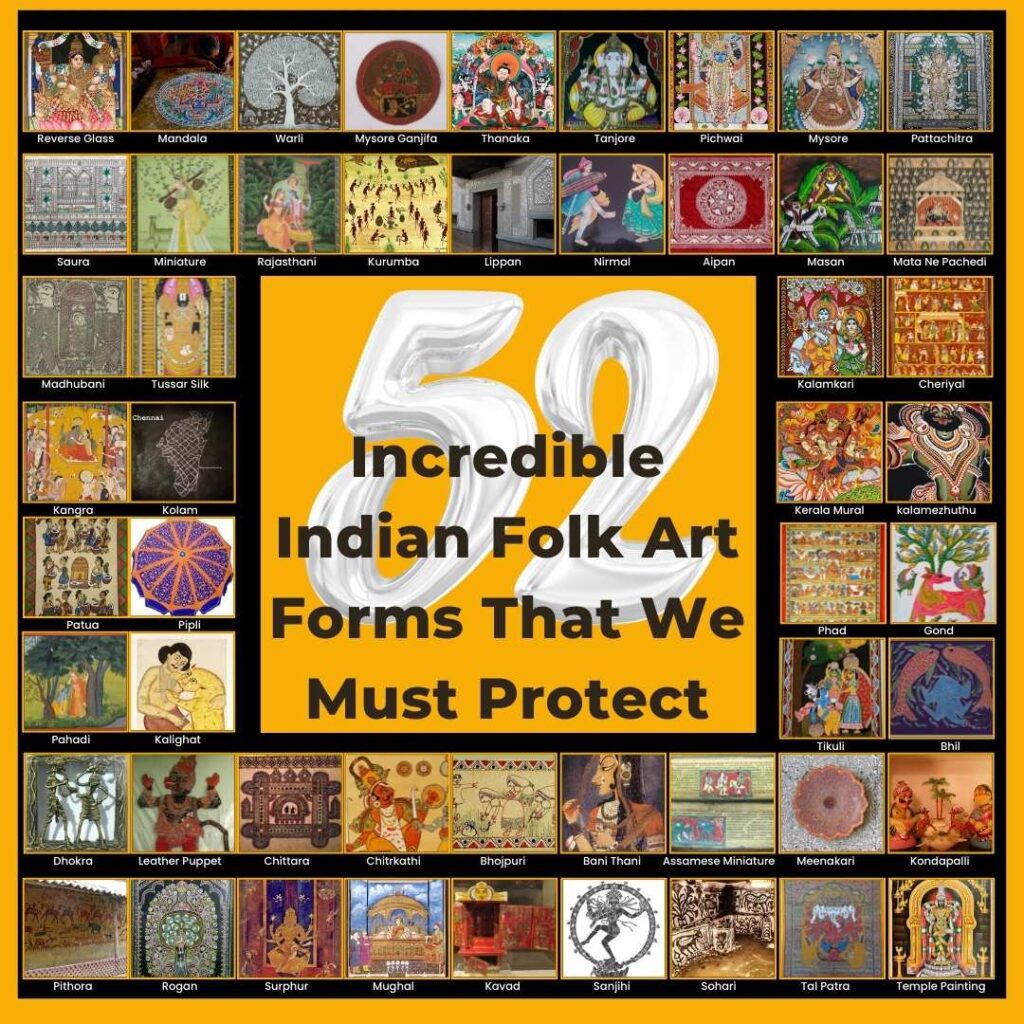

Further adding complexity, reports surfaced today regarding potential changes to the EU's Generalized System of Preferences (GSP) scheme, with possible implications for specific Indian export sectors such as textiles and handicrafts. The details are still emerging, but close monitoring is crucial for businesses reliant on these preferential trade arrangements. Meanwhile, the Brazilian government announced new agricultural export regulations impacting the shipment of soybeans and other key commodities, potentially creating temporary bottlenecks for Indian importers relying on these sources.

Implications for Indian Import-Export:

- Increased Import Costs: The rise in crude oil prices directly translates into higher input costs for various sectors, potentially impacting inflation and consumer prices. Importers should consider hedging strategies to mitigate risk.

- Supply Chain Disruptions: The US-China trade war and the new Brazilian regulations create uncertainty and potential supply chain disruptions. Indian businesses need to diversify their sourcing and explore alternative markets to reduce dependence on volatile regions.

- Currency Fluctuations: The strengthening US dollar increases import costs. Exporters may benefit from increased international demand, but this advantage may be eroded by increased input prices. Foreign exchange risk management is paramount.

- Strategic Re-evaluation of Export Markets: The potential changes to the EU's GSP scheme require a thorough review of export strategies for sectors affected by the scheme. Businesses should assess the potential impact and explore alternative market opportunities.

- Hedging and Risk Management: Given the volatile global environment, effective hedging strategies for currency risk, commodity price fluctuations, and supply chain disruptions are crucial for minimizing losses and maintaining profitability. Consult with financial experts and trade insurance providers.

- Government Support and Policy Advocacy: Indian businesses should engage actively with the government to advocate for policies that support trade diversification, infrastructure development, and risk mitigation strategies. Lobbying efforts should focus on addressing the challenges highlighted by the current trade dynamics.

- Enhanced Due Diligence: Businesses should strengthen their due diligence processes for suppliers and partners to ensure compliance with evolving regulations and avoid potential disruptions.

- Technology Adoption: Investing in technologies that enhance supply chain visibility, track shipments, and optimize logistics can help mitigate some of the risks associated with volatile global trade conditions.

Conclusion:

The global trade environment remains dynamic and challenging. The developments outlined today underscore the need for Indian importers and exporters to adopt proactive, flexible, and strategically informed approaches. Diversification, hedging, risk management, and close monitoring of global events are essential for navigating these turbulent waters and ensuring the continued success of Indian businesses in the international marketplace. Staying informed and adapting swiftly are key to mitigating risks and capitalizing on emerging opportunities. This requires close attention to regulatory developments, market analysis, and proactive engagement with government bodies and industry associations.

Source: Original